Are you considering applying for a business loan, but not sure about the process or what a lender will ask for?

First, you’re not alone. Many successful entrepreneurs have questions and encounter obstacles before they succeed in securing a business loan.

Second, this guide is for you! It will lead you through a series of steps designed to inform, empower, and support. While we present this as a linear process, feel free to skip around. Depending on your situation, the order of steps may vary and you may want to work on several at once.

This Getting Loan Ready guide is broken into several sections so you can pick and choose which apply to you and your business.

Most sections include links to pages with more detailed information, along with helpful resources and worksheets to guide your reflection and planning. If you're short on time, you can download a PDF version of the guide or subscribe to receive email updates below.

Either way, congratulations for investing in yourself and your business.

Empowering Entrepreneurs to Take Charge of Their Business Journey

Welcome! Before we begin, we’d like to explain how we approach supporting entrepreneurs like you.

- We believe you are capable, creative, and resourceful. Rather than seeking to fix or correct a lack, we focus on empowering you so you can take charge of your business journey and chart your path.

- We understand it can be lonely. When you are working hard to start or grow a business, it’s easy to feel alone. We strive to be a partner and an advisor. We also connect you to other resources so you can strengthen your network and build a team.

- We understand we don’t all start in the same place. While we believe change is possible and we champion your growth, we also understand that entrepreneurs face different challenges and realities.

How do these beliefs shape this resource?

- We breakdown a complicated and potentially overwhelming topic into smaller steps and components. We also always try to explain specialized vocabulary or terminology.

- We point you to other resources and present multiple voices and perspectives. We hope some will resonate with you and be useful.

- We let you choose your path through this material. Ultimately, this is your journey!

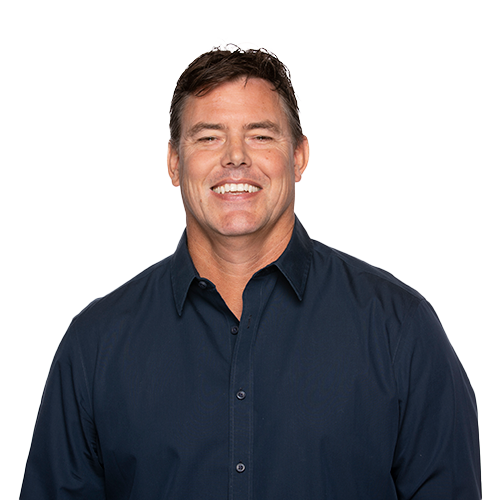

MEET THE CRAFT3 BUSINESS SERVICES TEAM

Aldo Medina Martinez, VP

Business Services Program Lead

"Small businesses are the heart of our local economies, that is why my life’s work revolves around empowering immigrant and folks of color to leverage entrepreneurship to create vibrant communities and build wealth for their families."

Joel Navarrete

Business Liaison

“I am excited to be a part of Craft3 and directly contribute towards community development and financial empowerment for those who need it most.”

Miri Plowman

Business Services Coach

“I love helping to turn the big ideas that live in an entrepreneur's brain into numbers and words that can be digested by lenders.”

Table of contents

Unleash the Potential of Your Business with a Solid Plan

If you’re serious about launching or growing a business, a business plan is a must.

A business plan is a roadmap for you and any potential partners and funders. You’ll also likely need a written business plan if you are seeking funding for a startup, for business expansion or for a business less than 2 years old.

A business plan:

- summarizes your business, how it is structured, and your plans for the immediate future

- explains who you will sell your goods and services to and how you will find your customers

- analyzes your competition and the competitive advantage your business has in the market

- identifies your strengths, weaknesses and what it will take to be profitable

A business plan can help you strategize and chart your course. Business plans come in many shapes and sizes. You can find some great resources to help you get started online.

Deep Dive

To dive deeper, visit our full Unleash the Potential of Your Business with a Solid Plan page. It features a detailed breakdown of key business plan sections, video guides, templates, and other resources to support you in building a strong, effective plan. Whether you're starting from scratch or improving an existing one, these tools will help you move forward with clarity and confidence.

OUR CUSTOMERS

When Sundown, owner of Chesed Farms, first connected with Craft3, he had a solid idea but didn’t have a business plan. We recommended he work with the local Small Business Development Center on a business plan. He put in that work, came back to Craft3, and we were able to make a loan for him to build out a new warehouse space.

Understanding and Using Financial Statements for Your Business

Understanding, creating, and using financial statements can help you make informed and strategic decisions about how to run and grow your business.

Unfortunately, financial statements inspire fear and anxiety for some entrepreneurs.

Entrepreneurs typically have many skills, but finance and bookkeeping are not always among them. Most lenders, however, will want to see financial statements before making a loan. And basic financial statements are not just a hurdle to jump over to get a loan. They are tools to help you understand your business.

While you don’t need to become an accountant, increasing your comfort and understanding of basic financial statements can be very helpful. The three most important financial statements include:

- Profit and Loss

- Balance Sheet

- Cash Flow

Taken together, these three interrelated financial statements can give you powerful insights into your business’ profitability, its financial condition, and expected cash flow.

Deep Dive

To dive deeper, visit our full Understanding and using Financial Statements for your Business page. It includes a clear explanation of key financial statements—including income statements, balance sheets, and cash flow projections—along with video guides, templates, and other resources. Whether you're learning the basics or refining your financial skills, these tools will help you better understand your numbers and make informed business decisions.

Craft3 meets customers where they are

When a creative and talented chef contacted us about a loan to turn his side business into a fulltime venture, he has a solid business plan and delicious products. But up to this point he hadn’t done any formal bookkeeping.

We looked at his Square receipts and put together some financial projections before issuing a $45,000 loan. We’re often able to work with entrepreneurs who have strong businesses, but incomplete financials or unconventional bookkeeping.

At Craft3 we’re committed to helping entrepreneurs grow and thrive.

In addition to often being able work with incomplete financials, Craft3 offers resources to help you understand and create your own basic financial statements. Our network of professionals is part of the value of working with Craft3. We may not have all the answers, but we know someone who does. We also can connect you to certified public accountants (CPAs), bookkeepers, and other service providers.

Determine if a Loan Can Help Your Business Succeed

Whatever a loan enables should improve your business and increase your profits.

A loan might help you increase productivity, lower your costs, or grow your sales. If it doesn’t do one of those things, then debt likely isn’t the answer — at least not right now.

For example, if you’re thinking of using a loan to bail yourself out of a difficult situation, that’s a red flag. As is not having a clear sense of how a loan will enable your business to succeed.

Do you have a simple and persuasive explanation for how a loan will improve your business?

- Yes. Congratulations! This is an all-important step in getting ready to apply for a loan.

- No. We recommend you don’t apply for a loan right now and instead work on your business plan and determine how a loan fits into that plan.

At Craft3, we look at historic DSCR, but we also consider projections if your historic DSCR isn’t high enough to support the loan.

How much can you afford to borrow?

The industry standard measure of this is your debt-service coverage ratio (DSCR). You can calculate your DSCR by dividing your cash flow (the net profit, plus any interest, depreciation, or amortization expenses) by your debt payments.

Deep Dive

To dive deeper, visit our full Determine if a Loan Can Help Your Business Succeed page. It offers guidance to help you evaluate whether financing is the right move for your business. Don’t worry if you don’t have exact figures—use the DSCR calculator to explore different scenarios and estimate how much you can realistically afford to borrow. The page also includes a helpful video resource and a cash flow template to support your planning.

Prepare to Discuss Your Business with a Lender

If you determine that your business would benefit from a loan and you’re ready to start reaching out to commercial lenders, it pays to be prepared to talk about your business.

Typically, you’ll talk to a commercial lender before submitting a full loan application. The lender will want to learn more about you, your business, and your financing needs.

Depending on what they learn, they may invite you to work with them and submit a full application. Or they may let you know why they don’t think you’re ready to apply quite yet.

If you are working with Craft3, whenever possible, we’ll connect you with resources so you can get loan ready or otherwise progress on your business journey.

Deep Dive

Talking to a commercial lender is an opportunity to make a strong first impression—and preparation can make all the difference. Our Prepare to Discuss Your Business with a Lender page offers a downloadable worksheet packed with insider tips to help you shine. You'll get a table of the most common lender questions, what smart lenders are really listening for in your answers, and space to organize your key talking points.

Thinking Like a Lender: Insights for Your Loan Application

Understanding your audience is helpful regardless of the situation.

If you’re considering applying for a loan, insights into how a lender thinks can give you an advantage.

While lenders are not all the same, here are a few common concerns:

- Lenders want to be repaid

- Lenders are interested in how invested you are in your business

- Lenders want to understand how your experiences, skills and temperament will help you succeed

- Lenders want to understand credit challenges in context

“As a banker, I often found myself saying, “No,” to good people with good ideas. Craft3, a mission-driven community development financial institution, can take more risks and make loans banks can’t. For example, we’re often able to finance good businesses with “bad” credit, so long as there’s strong business opportunity and plausible explanations for any credit blemishes.”

-Turner Waskom EVP, Chief Lending Officer

Deep Dive

To strengthen your loan application, it helps to understand how lenders evaluate your request. Visit our full Thinking Like a Lender page for insights into what lenders look for, along with practical tips, video resources, and templates. This guide will help you view your application from a lender’s perspective and prepare more effectively.

Simplify Your Loan Application Process with these Document Tips

The final step in getting loan ready is often gathering the supporting documents a lender will ask for.

Here’s what Craft3 requires:

- Signed application (NOTE: you can apply with an Individual Taxpayer Identification Number (ITIN))

- Two years of business and personal tax returns

- Personal Financial Statements from anyone who owns 20% or more of the business

- Two years of financial statements (profit and loss and balance sheet) plus year-to-date financial statements

- Projections for the next 24 months

- NOTE: If your business is established and has a historic ability to service the debt you are requesting, we typically don’t require projections

- Business Plan

Gathering these documents and statements will take time

Very likely more time than you imagined. We suggest you start before you apply and break the task down into parts so you’re not scrambling or spending a late night pulling everything together. Plus, it will serve you well to have this information readily available. Know that we are focused on simplifying the application process as we can and we aim to minimize the work required for you.

Takeaway

To make things easier, we’ve included a downloadable PDF checklist with all the required documents outlined in this article. You can use it to track your progress, stay organized, and avoid last-minute stress. It's a simple tool to help you move through the loan application process with more clarity and confidence.

Get Ready to Apply for a Loan: Consider Your Next Steps

This resource is focused on what it takes to get ready to apply for a loan.

We hope the information, tips, links, and worksheets we’ve shared have helped you learn more about the loan application process and provided manageable steps for you to follow.

Now we suggest you take a step back and consider where you are. The graphic below shows the getting loan ready journey as a timeline. In practice, it’s often full of twists and turns, and the order of the steps can vary depending on your business and your situation.

As you consider the milestones and setbacks, ask yourself:

- What steps have you completed?

- What work remains?

- What potential setbacks are you worried about?

Takeaway

We’ve created a Get Ready to Apply for a Loan: Consider Your Next Steps worksheet to help you reflect on where you are in your business journey and what’s ahead. It’s designed to guide you through your next steps, identify potential challenges, and keep you focused on your goals—even when the path isn’t linear. Use it anytime, whether you're planning offline or printing it out for later.

Plan Your Next Steps to Get Loan Ready!

Much like launching a business, getting loan ready is a journey.

It takes time. You may experience setbacks. We urge you to stick with it!

To help you plan your next steps, you might consider your answers to the questions we asked you in the previous section.

What do you see as the two most important next steps for you in getting loan ready?

The two steps that you identified above can help you focus your efforts. In our experience, entrepreneurs are more likely to succeed when they:

- break large tasks down into more manageable steps

- have a plan

- revisit their plan every few months

Tools and Resources to Help You Get Loan Ready

Thanks for spending time with this resource — and congratulations on taking a meaningful step toward strengthening your business.

This guide is just one piece of the support we offer small business owners. If you're looking for a deeper dive into preparing for financing, download our comprehensive Definitive Guide to Getting Loan Ready e-book in English or Spanish.

Start with the Basics

Get the resources you need to feel confident and prepared as you grow your business and explore financing options. Each download is designed to make complex concepts simpler and help you move forward with clarity.

-

Glossary of Finance and Business Terms Make sense of unfamiliar financial language. You don’t need to talk like a banker — but understanding their terms and mindset can help you communicate more effectively and make smarter decisions.

-

Unleash the Potential of Your Business with a Solid Plan A printable one-pager summarizing the key sections every strong business plan should include.

-

Understanding and Using Financial Statements for Your Business A quick-reference guide covering the essentials of income statements, balance sheets, and cash flow projections.

-

Determine if a Loan Can Help Your Business Succeed A printable worksheet to help you decide if financing is the right move for your business goals.

-

Prepare to Discuss Your Business with a Lender A practical worksheet featuring common lender questions, insights into what they’re really listening for, and space to organize your key talking points.

-

Thinking Like a Lender A printable guide to help you see your loan application from a lender’s perspective and prepare more strategically.

-

Simplify Your Loan Application Process with These Document Tips A checklist of the financial and business documents lenders typically require when applying for a loan.

-

Get Ready to Apply for a Loan: Consider Your Next Steps A reflective worksheet to help you assess your business’s current position and plan ahead for success.

-

Subscribe for Business Tips Get practical, actionable advice delivered to your inbox — covering everything from business plans to getting documents together.

When You’re Ready, We’re Here to Help

At Craft3, we specialize in working with entrepreneurs who may not fit the traditional mold — and we believe in second chances and fresh starts.

Take the Next Step

-

Explore Craft3’s Business Loan Options Learn how we support small business owners through accessible, flexible financing.

-

Submit a Loan Inquiry You can start the loan process by completing our online form. A lender will then follow up with you to schedule a conversation.

About Craft3

Craft3 is nonprofit community lender focused on building a thriving, just, and empowered Pacific Northwest. We support entrepreneurs — especially those that have been denied access to opportunity — by offering responsible capital and tools, like this guide, to support you on your business journey.